A woman from Luton has been sentenced after she made fraudulent claims on her employer’s income protection insurance policy, claiming she was unable to work when in fact she was working as a call centre operative elsewhere.

The fraud was investigated by detectives from the City of London Police’s Insurance Fraud Enforcement Department (IFED) after an anonymous letter was sent to her employer, tipping them off about the scam.

Balbinder Mahil, 45, of Beech Wood Road, Luton was sentenced to eight months’ imprisonment (suspended for two years), ordered to carry out 120hrs of unpaid work and ordered to pay just over £6,000 in compensation, costs and victim surcharges.

In July 2013, Mahil was due to return from maternity leave to her job working for a credit card company. However, she never went back, stating that she was unfit to work due to stress and provided various doctors notes to support this claim.

Mahil subsequently received payments through her employer’s income protection insurance policy, which was provided by insurance company Unum. Payments between July 2013 and May 2015 - when her contract was finally terminated - totalled £13,171.

However, an anonymous letter was sent to her employer stating that Mahil had been employed as a call centre operative for a healthcare company since August 2014 – at a time she was still receiving income protection payments for supposedly being unfit to work.

The case was referred to IFED detectives and after further enquiries they found that Mahil received around £6,000 of payments under the income protection scheme, whilst working at the call centre.

Mahil was interviewed by officers in September 2015, where she admitted that she was working at the same time she was receiving payments for supposedly being unfit to work.

She was charged in May 2016 with fraud by false representation and subsequently pleaded guilty to the offence and was sentenced as above.

Detective Constable Jamie Kirk from the Insurance Fraud Enforcement Department said:

“Mahil knew that she was being dishonest and she should have told her employer she was able to work again. There is a perception that this sort of thing is acceptable but our message is that not only is it dishonest, it is also illegal and you could end up with a criminal record if you commit insurance fraud.”

Tim Bishop, Financial Crime Prevention Manager at Unum commented: “Unum takes a firm line on fraud, investigates any suspicious claims and works closely with IFED to make sure that fraudsters are brought to justice.

“This result, achieved by working in collaboration with the Policyholder, reinforces Unum’s approach to claim management which is to ensure that we protect our genuine claimants by taking firm action against those who commit fraud.”

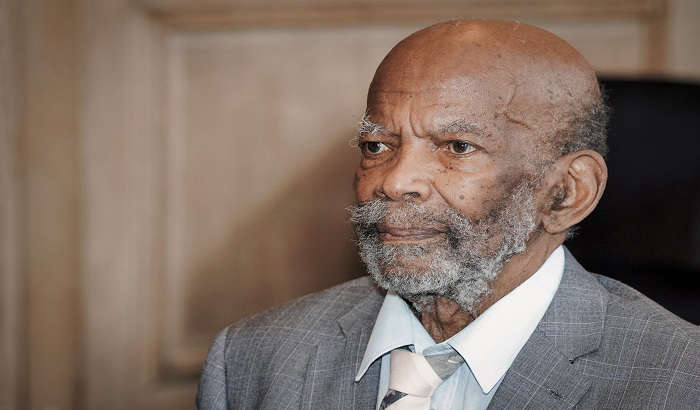

City presents Windrush pioneer with prestigious Leeds Award

City presents Windrush pioneer with prestigious Leeds Award

More Than 10,000 Arrests Made By Team Dedicated To Reducing Violent Crime

More Than 10,000 Arrests Made By Team Dedicated To Reducing Violent Crime

Plate expectations as historic registration could be up for sale

Plate expectations as historic registration could be up for sale

Calderdale: Celebrating over 350 years of service at Council

Calderdale: Celebrating over 350 years of service at Council

Activists who caused £100,000 worth of damage sentenced

Activists who caused £100,000 worth of damage sentenced

Appeal Following Collision and Death of Man in Otley, Leeds

Appeal Following Collision and Death of Man in Otley, Leeds

Vehicle involved in fly tipping across West and North Yorkshire seized by Bradford Council

Vehicle involved in fly tipping across West and North Yorkshire seized by Bradford Council

Anti-social behaviour funding boost in Clitheroe, Colne and Darwen

Anti-social behaviour funding boost in Clitheroe, Colne and Darwen

Leeds City Council to launch review on taxi vehicle condition standards

Leeds City Council to launch review on taxi vehicle condition standards

Man Named After Fatal Road Traffic Collision, Leeds Road, Bradford

Man Named After Fatal Road Traffic Collision, Leeds Road, Bradford

Over £4,000 raised for Mental Health Charity in Bradford

Over £4,000 raised for Mental Health Charity in Bradford

Remix Saturdays

Remix Saturdays

The Golden Era

The Golden Era

Legal Show

Legal Show

Bhangra Nights

Bhangra Nights