A gang of four from Walsall have been sentenced for setting up a motor insurance scam which saw them take out fraudulent motor insurance policies, make fictitious claims against the policies and then sell the claims on to solicitors firms who paid the group referral fees for what they thought were genuine claims.

The large-scale fraud was first uncovered after a fraud investigator at esure spotted a suspicious motor insurance claim, which led them to identify more than 20 fraudulent policies linked to the same group. The case was referred to the Insurance Fraud Enforcement Department (IFED), part of the City of London Police, where officers were able to piece together evidence that showed how the group conspired together to defraud the insurance companies and solicitors that took on the bogus accident claims.

In total, the group was responsible for instigating fictitious insurance claims estimated at close to £500,000 and they defrauded solicitors firms in around the Walsall and West Midlands area out of more than £45,000 by selling on the fake claims via claims management companies they had set up.

The group were sentenced at the Old Bailey to:

- Nagman Aftab of Arundel Street, Walsall, 2 years imprisonment suspended for 2 years.

- Rameez Ajaib of Delves Road, Walsall, 18 months imprisonment suspended for 2 years.

- Moheen Akhtar of Poplar Avenue, Walsall, Community order: 100 hours of unpaid work within the next 12 months. Community order: 100 hours of unpaid work within the next 12 months.

- Nabeela Begum of Alexandra Road, Walsall Count 1-2 years imprisonment suspended for 2 years.Count 2-12 months imprisonment suspended for 2 years and to run concurrent to the above sentence for count 1.

In April 2012, esure received seven personal injury claims made against a motor insurance policy. But when the details of the claim were checked, fraud investigators at esure discovered that the two vehicles that were said to have been involved in the collision in the Birmingham area were in fact on sale in forecourts in Hatfield and Milton Keynes at the time of the alleged collision.

Further enquiries by esure linked 21 other fraudulent motor insurance policies through either common phone numbers or bank account numbers that had been used to incept the policies. Their investigators also listened to recordings of some of the phone calls made when the policies were taken out and found it was the same voice on the recordings.

The case was referred to IFED and Aftab was linked to the fraud by IFED investigators when they discovered his home address was connected to one of the accident claim management companies that sold on some of the fictitious claims to solicitors firms to pursue.

IFED investigators found the group had taken out policies with other insurers including AXA and Haven, with the earliest frauds dating back to March 2011. Financial enquiries also helped officers to identify Begum and Nagman as being involved, with bank records showing they had both received payments into their accounts from solicitors that had fallen victim to the scam.

When officers raided Begum’s address they discovered several claim referral packs and template documents she was using to sell the fictitious claims on to solicitors firms. Ajaib, who was Begum’s boyfriend at the time, was linked to the scam when his fingerprints were found on the claim referral packs. Officers also found Ajaib’s name and address were connected to the registration of the claims management companies the group using as a front to sell on the false claims to the solicitors.

All four were charged with conspiracy to defraud, with Ajaib, Akhtar and Begum also charged with money laundering, with all four eventually pleading guilty to the offences.

Detective Chief Inspector Oliver Little, from the Insurance Fraud Enforcement Department, City of London Police said: “This was a well organised criminal group that set out to defraud both insurers and solicitors on a considerable scale. Thanks to the vigilance of esure’s investigators, coupled with the excellent work of our officers, this group has been stopped in its tracks and further losses have been prevented."

“We work closely with the insurance industry to identify criminal groups such as these to prevent them from profiting from insurance fraud and will continue to investigate and put insurance fraudsters in front of the courts.”

Appeal After Burglary

Appeal After Burglary

Have your say and help to build stronger communities in Calderdale

Have your say and help to build stronger communities in Calderdale

Bradford to mark the 80th anniversary of D-Day

Bradford to mark the 80th anniversary of D-Day

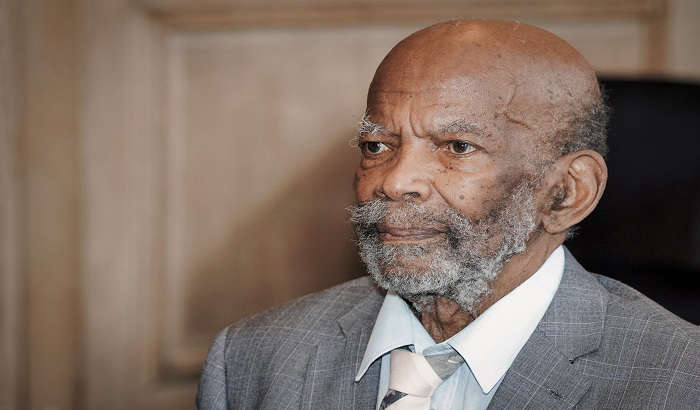

City presents Windrush pioneer with prestigious Leeds Award

City presents Windrush pioneer with prestigious Leeds Award

More Than 10,000 Arrests Made By Team Dedicated To Reducing Violent Crime

More Than 10,000 Arrests Made By Team Dedicated To Reducing Violent Crime

Plate expectations as historic registration could be up for sale

Plate expectations as historic registration could be up for sale

Calderdale: Celebrating over 350 years of service at Council

Calderdale: Celebrating over 350 years of service at Council

Activists who caused £100,000 worth of damage sentenced

Activists who caused £100,000 worth of damage sentenced

Appeal Following Collision and Death of Man in Otley, Leeds

Appeal Following Collision and Death of Man in Otley, Leeds

Anti-social behaviour funding boost in Clitheroe, Colne and Darwen

Anti-social behaviour funding boost in Clitheroe, Colne and Darwen

Alim OnAir

Alim OnAir

Legal Show

Legal Show

The Golden Era

The Golden Era

Bhangra Nights

Bhangra Nights